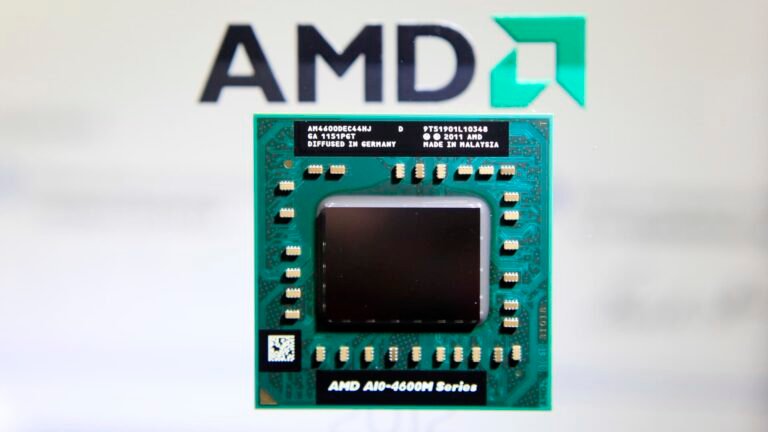

Take a look at the businesses making headlines in noon buying and selling. Superior Micro Units – The chipmaker’s inventory rose 7%, a day after the corporate unveiled new AI chips poised to problem Nvidia’s dominance. Nvidia shares added about 1%. Meta Platforms and Microsoft have already stated they are going to purchase the AMD chip as a substitute. Alphabet – Inventory of Google’s mum or dad firm rose greater than 5%, a day after the corporate unveiled its newest and strongest synthetic intelligence mannequin often called Gemini. The product will likely be used to energy Google merchandise equivalent to its Bard chatbot. Sprinklr – Shares fell about 30% on the again of the corporate’s quarterly earnings announcement. Regardless of posting better-than-expected fiscal third-quarter 2024 outcomes on Wednesday, administration expects gross sales development to sluggish in fiscal 2025. BTIG downgraded the inventory to impartial from purchase following the discharge. AbbVie – AbbVie shares rose 1% a day after the drugmaker introduced it might purchase neuroscience drug firm Cerevel Therapeutics for $8.7 billion, or $45 per share. The corporate expects the acquisition to happen in the midst of subsequent yr. Cerevel inventory jumped greater than 12%. Chewy – The pet merchandise e-commerce inventory fell greater than 3% every day after Chewy reported disappointing quarterly outcomes and steering. Income fell barely beneath expectations, and Chewy reported a larger-than-expected lack of 2 cents. Web gross sales steering for the fourth quarter additionally got here in beneath the $2.93 billion anticipated, in line with LSEG, previously often called Refinitiv. GameStop – GameStop shares had been final up practically 2% a day after the online game retailer reported third-quarter outcomes. The corporate reported a lack of 1 cent per share on income of $1.08 billion. It was not clear whether or not this was much like the LSEG estimates. JetBlue – JetBlue shares rose greater than 13% after the airline boosted its steering because of robust journey demand. The corporate expects income to say no between 7% and 4% from a yr in the past within the fourth quarter. Earlier steering known as for a decline of between 6.5% and 10.5%. JetBlue additionally expects a smaller-than-expected fourth-quarter lack of between 25 cents and 35 cents. ChargePoint – ChargePoint shares rose greater than 11%. On Wednesday, the electrical car charging inventory reported income of $110 million, falling wanting the $122 million anticipated by analysts surveyed by LSEG. C3.ai – The AI software program inventory fell greater than 10% after C3.ai launched combined quarterly outcomes and lightweight company steering. On Wednesday, C3.ai reported a lower-than-expected adjusted lack of 13 cents per share. For the fiscal third quarter, the corporate expects income to vary between $74 million and $78 million. Take-Two Interactive – Shares fell practically 2% after Financial institution of America downgraded the online game writer to a impartial score from a purchase score, citing the corporate’s historical past of delaying launches. Duckhorn Portfolio – Wine inventory fell greater than 9% every day after Duckhorn launched quarterly outcomes that fell wanting Wall Road expectations. Financial institution of America downgraded the corporate to impartial, citing “few causes to be bullish” within the close to to medium time period. — CNBC’s Sarah Min, Alex Haring, Hakyung Kim and Michelle Fox contributed reporting.