A bull run is sort of a forest fireplace: it wants a set of circumstances to start out.

A wildfire wants an extended interval of no rain, excessive temperatures after which robust winds on the level of ignition.

Sure, the wildfires have been exacerbated by file methane emissions that Bitcoin helps mitigate, however that is not what this text is about: this time it is simply an analogy.

The halving causes the brand new provide of Bitcoin to dry up (no rain). They’re attracting rising curiosity within the timing of Bitcoin market entry (excessive temperature). However in addition they require excessive winds and ignition to happen.

These robust winds are the winds of change across the Bitcoin ESG narrative.

The ignition occasion would be the first giant ESG funding committee to again Bitcoin for ESG causes.

The issue confronted by the rising quantity of environmental, social and institutional buyers

By 2026, ESG-focused institutional funding will rise to $33.9 trillion. That is greater than $1 for each $5 of property beneath administration, in accordance with a PwC report.

However crucial discovering from the report that ought to alert present and future Bitcoin holders is that ESG and institutional buyers have an issue proper now: demand for robust ESG investing is outpacing provide. ESG buyers take a very long time to search out appropriate ESG investments, with 30% of buyers saying they battle To seek out engaging funding alternatives associated to environmental, social and governance facets.

Bitcoin is now in first place to reply this downside. This is why:

Alternative for Bitcoin

2023 has seen a shift within the ESG narrative round Bitcoin.

In simply 53 golden days from August 1 to September 22 this 12 months, 5 occasions helped upend Bitcoin’s environmental, social and governance narrative. She was:

1. KPMG Report Concludes Bitcoin Helps ESG Crucial (August 1)

2. Peer-reviewed analysis helps speculation that Bitcoin may be good for the surroundings (August 8)

3. Cambridge Admits Bitcoin’s Energy Is Overrated (August 30)

4. Bloomberg Intelligence Charts Present Bitcoin Mining Results in Decarbonization (September 14)

5. Danger Administration Institute Concludes Bitcoin Helps Renewal Transition (September 22)

These reviews and analysis papers had been produced independently, from very respected researchers and organisations, and fairly than concluding that Bitcoin was “not as unhealthy for the surroundings as we thought”, they got here to a a lot stronger conclusion that Bitcoin was a internet constructive as an environmental, social and company governance asset. .

These winds of change will probably intensify into the robust winds that Bitcoin wants to finish the set of circumstances essential for a rally.

What does this imply

Info is energy. At present, there’s an info asymmetry. The narrative has modified primarily based on new knowledge. However most environmental, social and institutional buyers do not have this knowledge. Till now. Till they get this new knowledge, they’ll proceed to imagine the previous narrative that “Bitcoin has a adverse impression on the surroundings.”

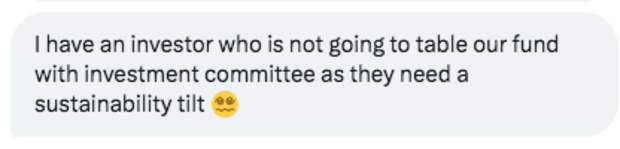

In case we wanted proof of that, this is a direct message I obtained from a fund supervisor a couple of days in the past.

Some of these ESG buyers are nonetheless unable to deploy the next proportion in Bitcoin as a result of their ESG info for Bitcoin is a number of years outdated, and they don’t seem to be conscious of the 5 narrative flip occasions described above.

Whereas ESG Funding Committee members’ views on Bitcoin are sometimes very adverse, my expertise has been that not like environmental NGOs, their views are additionally free. After I was in Sydney just lately, a younger Australian excitedly cornered me and stated: “Dan – you used your charts to peel the orange on our funding committee!”

So, what’s going to occur when this info asymmetry is blown away by the robust winds of Bitcoin’s new ESG narrative?

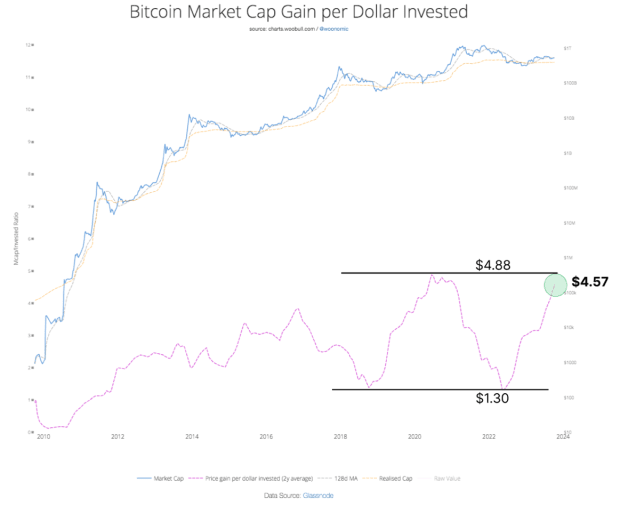

Due to Willie Wu’s evaluation, we are able to decide what this may imply for Bitcoin’s market cap throughout the vary.

Decide how ESG = NGU

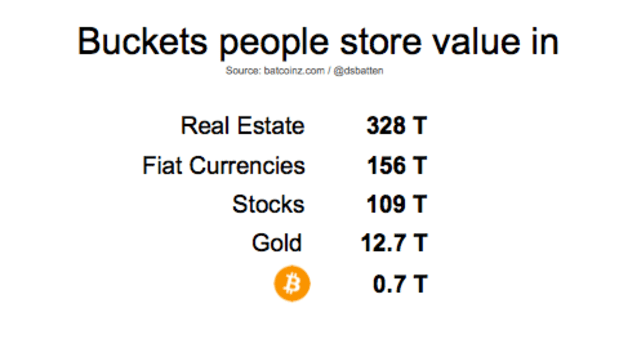

Bitcoin’s ESG adoption is extraordinarily bullish for the comparatively thimble-sized Bitcoin market of $713 billion on the time of writing. Wu argues that Bitcoin should stay above $1 trillion earlier than establishments that maintain the wealth of nation-states and/or pension funds will really feel comfy investing in it collectively.

What is going to occur subsequent to Bitcoin’s market cap if ESG buyers deploy 1% of their 2026 property beneath administration in Bitcoin?

In accordance with the share improve in market capitalization per greenback invested in the present day – the market worth of Bitcoin will rise to $2.26 trillion. That is greater than thrice what it’s in the present day.

If 2.5% of ESG funds’ AUM had been deployed in Bitcoin, it will improve the market capitalization to $3.87 trillion. That is greater than 5 occasions in the present day’s market worth. This places it squarely on the roadmap for institutional buyers, which leads to extra capital being deployed, which in flip creates a really constructive suggestions loop.

Even with out this suggestions loop, a 2.5% ESG rollout might stimulate Bitcoin’s value by round $193,000 throughout a possible 2026 bear market.

This isn’t a prediction however a simulation. I say if ESG ICs deployed 1-2.5% of AUM, then The consequence may very well be 2-5x the market cap of Bitcoin.

Nevertheless, Bitcoin has the distinctive potential to grow to be the world’s first greenhouse-negative business with out offsets: one thing that may require diluting the methane from Bitcoin mining in simply 35 medium-sized landfills. If that occurs by the possibly robust 2026 time-frame, I’d be shocked if Bitcoin does not obtain a 2.5% deployment of property beneath administration for an ESG investor or extra.

ignition

As if we wanted additional affirmation that the winds of change within the ESG narrative are blowing, I just lately spoke on the 2023 Plan₿ Discussion board in Lugano on the subject “Bitcoin is the World’s Greatest ESG Asset.” I had the concept of utilizing the immediate for each Michael Saylor and previously Baseload, turning it right into a key phrase supported by supporting knowledge.

The recording is at the moment essentially the most seen speak from the 2023 convention on YouTube, not due to any notoriety on my half (there have been rather more well-known audio system) however as a result of as Victor Hugo as soon as stated: “Nothing is extra highly effective than an concept whose time has come.” “.

Bitcoin as an ESG asset is an concept whose time has come. Bitcoin has now confirmed its capacity to extend renewable power capability and scale back methane emissions at a time when the world urgently wants options for each. Against this, Ethereum has now moved to Proof of Stake, and might not assist meet any of those speedy wants.

In early 2022, most Bitcoin customers had been nonetheless making an attempt to “defend” Bitcoin towards environmental, social, and governance (ESG) assaults with statements like “however garments dryers use extra power than us.” However by 2023, Bitcoin customers started taking the sport into the opponent’s half, with continued success. The technique of sharing fact-based reporting and provoking tales in regards to the constructive ESG case for Bitcoin is working: this 12 months, each The Hill and Bloomberg started publishing constructive press reviews about Bitcoin mining. Mainstream constructive information protection outnumbered adverse accounts by a ratio of 4:1. After which in fact there have been 53 days of narrative twists.

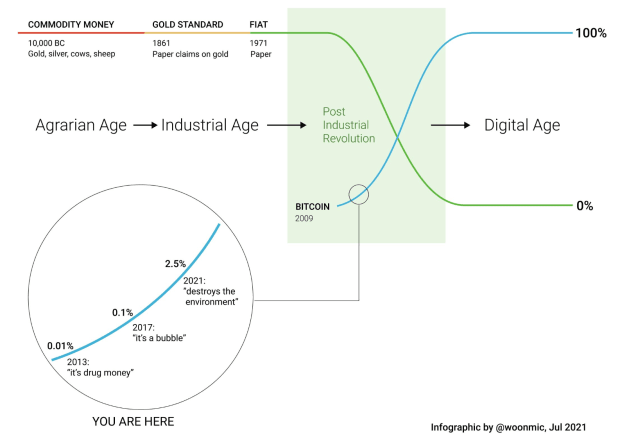

Each 4 years, a brand new false narrative emerges.

Nevertheless, each 4 years, that is additionally “TikTok, the subsequent false narrative for the chopping block.”

The story that Bitcoin is “environmentally harmful” is, if not lifeless, at the very least half-baked.

The approaching halving will additional dry up Bitcoin provides whereas concurrently rising investor curiosity. On the identical time, the winds of change within the environmental, social and governance narrative are accelerating. Situations are actually very best to ignite the inevitable spark for a significant ESG cash deployment in Bitcoin.

ESG = IS.

Daniel Batten is the founder CH4Capitalwhich gives infrastructure financing to Bitcoin mining firms that run on methane gasoline emitted from landfills.

This can be a visitor publish by Daniel Patten. The opinions expressed are totally their very own and don’t essentially mirror the opinions of BTC Inc or Bitcoin Journal.